Employee or Independent Contractor?

June 19, 2020

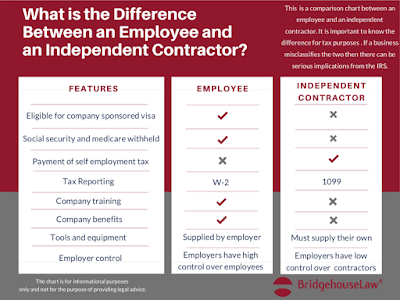

What is the Difference Between an Employee and an Independent Contractor?

Knowing the difference between an employee and an independent contractor is not always easy. But employers must know the difference in order to have appropriate liability protection and to be compliant with labor and tax laws.

Employers sometimes try to classify their employees as independent contractors to avoid paying payroll taxes. They might think the IRS won’t notice, but in reality the employer’s classification is irrelevant to how the IRS determines if a worker is an employee or independent contractor. The IRS has a long list of factors to consider when they evaluate the relationship to see if your independent contractor is truly an independent contractor.

Some of those factors include:

• How much control does the employer have over the worker’s behavior? Is the worker trained by the employer? Does the employer control how and when the worker does his/her work? Does the worker have to follow the rules that the employer sets for employees?

• What kind of payment does the worker receive? Is the worker paid a flat rate? Is the worker paid hourly/have a salary? Is the worker reimbursed on expenses?

• What is the relationship like between the employer and the worker? What type of relationship is described in the contract? Does the worker receive benefits from the employer?

All of these things are considered when looking into the relationship between a worker and an employer. If you think designating a worker as an independent contractor will allow you to avoid paying payroll taxes, you may want to think again. The IRS is extremely rigorous when it comes to this topic and there are financial and legal repercussions if an employee is misclassified.

Millions of employees in the United States are misclassified as independent contractors. If an employee feels that he/she is being misclassified as an independent contractor, they can submit a Form 8919 to the IRS.

Not all employers misclassify their employees on purpose, but the mistake can be costly. In order for employers to avoid this, they can use a Form SS-8 to help evaluate the type of relationship they have with their workers. The Form 8919 and Form SS-8 can both be found on the IRS website.

Since the IRS makes resources available to better understand how to classify the relationship between employers and workers, there is low tolerance for misclassification. Make sure that you understand the difference because the penalties, which can include prison time, are not worth it.

References:

*This blog is for informational purposes only and not for the purpose of providing legal advice.

Best regards

und viele Grüße aus Charlotte

Reinhard von Hennigs

www.bridgehouse.law

und viele Grüße aus Charlotte

Reinhard von Hennigs

www.bridgehouse.law